NEXT GEN INVESTING:

HOW UNDERREPRESENTED INVESTORS ARE CHANGING THE GAME.

Future Capital Learning Team

In the last 2 years, we’ve gone from researching and concept testing a way to activate a new category of angel investors to launching a diverse network of early-stage investors - across two countries. Through a combination of startup investing courses, ‘closed door’ meetings with founders, strategic industry activations and a number of co- created pre-seed deals, we’ve managed to establish a 300+ person network of startup investors that invert the demographics in the industry and they’re taking an unconventional approach to venture investing.

The first 50 investors came in succession in the summer of 2020 with a strict gender and regional focus - 3 back to back cohorts of emerging women investors in Atlantic Canada. We tested a new, proprietary curriculum designed to engage investors with limited access and experience in venture and we credit those initial engagements for creating a roadmap to 300.

In the 12 months after that, we’ve been able to expand the tent to over 300 new and emerging early-stage investors. Some of them came to us with a handful of deals under their belt. Some of them came to us with no knowledge of the space. Some came to us with big plans to launch their own funds, syndicates and angel groups. Rather than apply a one-size-fits-all approach, we’ve consistently evolved and customized our learning experience to meet each investor where they’re at.

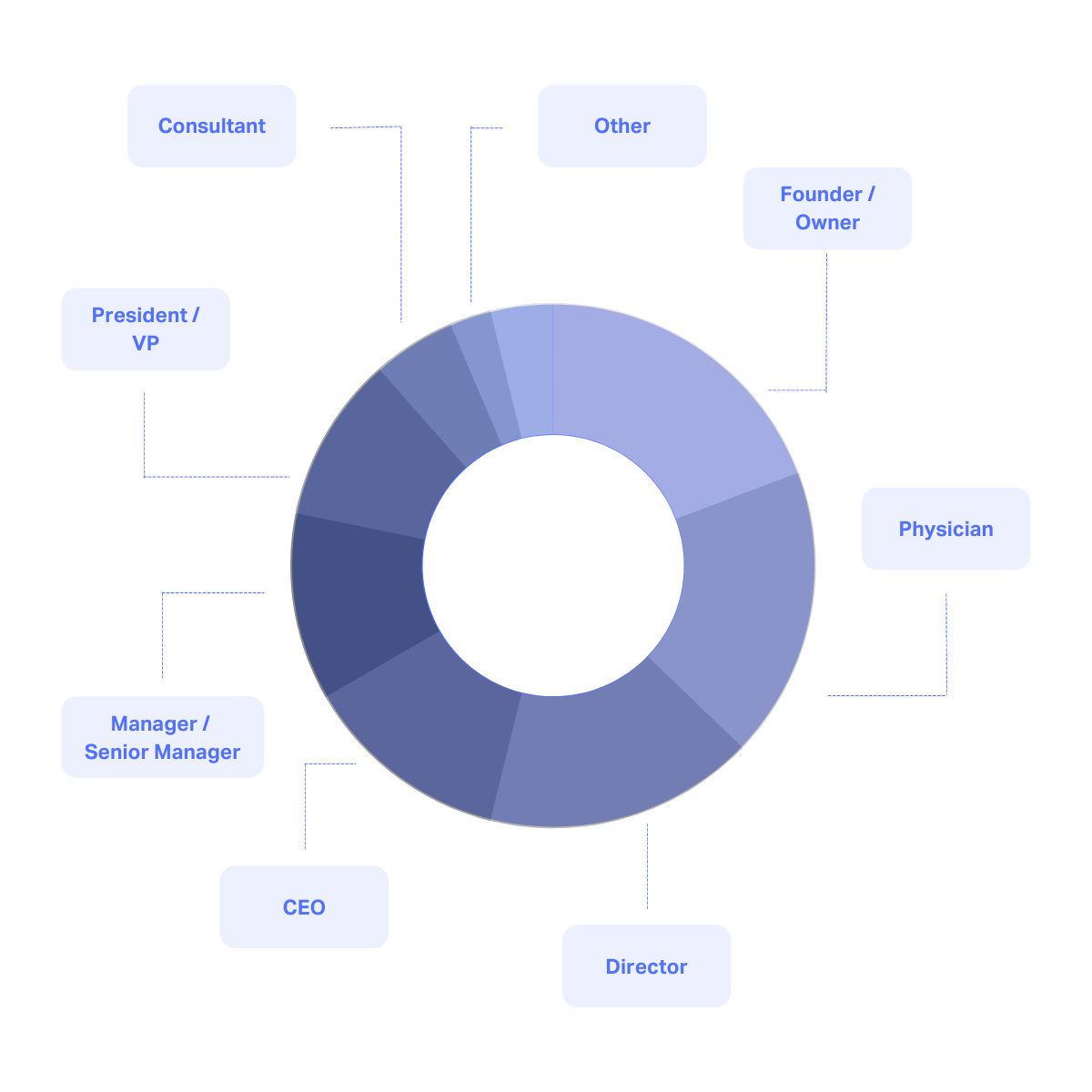

After leading 27 cohorts across 15 regions across North America, we’ve been exposed to a wide variety of seed and pre-seed investors. Here’s what we’ve learned from working with them.

They index towards companies that focus on consumers

Conventional wisdom would suggests that investors focus on companies that meet an investment thesis that tracks towards ‘low-risk’ businesses with very specific unit economics and narrow founder profiles. The activity within our network over the past year has demonstrated that there's a notably different way of decision making that has been severely under-utilized in the market.

Our core role as a team is to provide investors with a steady pipeline of high-potential investment opportunities. Sector agnosticism has been an important caveat for us as we consider who and what to share with our network. Instead of presuming that the people we’re working with have aligned interest to the broader VC market, we crowdsourced the sectors, stages and models that our network wanted to engage with. By and large, we’ve witnessed a shift away from SaaS and enterprise products and an overwhelming interest in products and services that enable the consumer.

According to the North American Venture Capital Association (NVCA), enterprise and technology businesses take up a huge share of the available funding in the broader VC market. This means there is a meaningful opportunity for outsiders to play big in alternative spaces. Moreover, getting involved at the earlier stages, these investors stand to gain hyper-relevant experience, tap into entirely new networks and increase their prospects for follow-on investments and meaningful exits over time.

They work well in collaboration

The most rudimentary version of our network would include a spreadsheet, and emails that connect investors to investment opportunities. It would be reasonable to assume that if the biggest barrier to entry - apart from the capital requirements - is access to deal flow. The solution could be as simple as exposing both sides of the marketplace to one another. What this assumption skips over is the social, emotional & psychological parts of investing.

The parallels between angel investing & collecting art are many - but one of the most evident is that you should love and understand what you invest in.

Most competitive seed & pre-seed rounds set a minimum check size at $25,000. For newer investors, this means a meaningful amount of their own money is going into a new venture, often times run by a founder that they are still learning about and typically with a lack of historical data or financial track record to fall back on.

The nature of fundraising for a large majority of founders is about the quality and volume of investor meetings. There simply isn’t enough time or capacity for founders to go on a 2nd, 3rd or 4th date with most of their angel investors. But by taking a collective approach to venture assessment, the opportunity for rich dialogue opens right up.

Our informal, closed-door investor pitches are designed to create a safe and open space for investors to unpack a pitch, form their perspective, talk to the founder and leverage the insights and industry knowledge from a broader community to make an investment decision that feels good.

Their experience should not be underestimated

Venture investing is not rocket science. It’s also not for the faint of heart. The realities of navigating the VC and angel investing are complex, fun, demanding, educational and frustrating all at the same time. Within the FinTech space alone, there are a number dominant subcategories including payments, lending, insurance, equity financing and personal financing. Beyond categorization - there is an even wider range of technologies, applications and go-to- market strategies to sift through and understand.

The level of diversity that exists within any given sector means that even a seasoned venture capitalist or angel investor is in a perpetual state of learning. Yet there is a persistent myth that only folks with a very specific background have the ability to add value and/or drive the growth of a startup. The role that diversity will play in the next phase of venture is barely even recognizable at this stage because of the stagnant diversity metrics in the industry. That said, we are already seeing unexpected synergies and wells of expertise as we tap into brand new talent pools within an emerging class of new investors.

You don’t have to look too far beyond basic human behaviour to understand why. A more diverse group of investors are going to be more likely to invest in products and services that resonate with a broader group of consumers.

They invest in diverse founders

Diversity has been one of the most difficult needles to move in venture. There is an overwhelming abundance of data and reporting that will tell you just how difficult the broader VC and angel investing landscape is for founders that aren’t a) male identifying b) highly-educated c) white d) well connected out of the gate. This systemic problem has persisted - and in some cases worsened - despite the an increased number of funds, initiatives, accelerators and government programs aimed at the problem.

One of the key insights that our work with a new, emerging community of diverse investors is able to provide is that there is, in-fact, a direct correlation between decision- makers in venture and the demographic makeup of startup leaders.

Our growing portfolio of companies that have been funded through the network looks very different from the rest of the industry. Cis-genered caucasian men makeup only 11% of our founder pool, while women identifying founders makeup 78%, LGBT+ founders makeup 22% and BIPOC founders are represented at 33% of the founders that our network has funded.

The most interesting piece of this puzzle is that our organization has no mandate on funding founders from any distinct background. Instead, we’ve placed an emphasis on enabling smart, ambitious business leaders from diverse backgrounds with the foundational skills to capture opportunities that matter to them.

They’re just getting started

Of the over 300 investors in the FC network only 12% had written an angel check before joining. Moreover, 30% of our investor partners have referred someone from their network into the Foundations in Startup investing. It’s hard to project the future of venture while the industry is in such a rapid period of growth and evolution. But what is abundantly clear to us is that there is a huge pool of untapped potential sitting amongst a new generation of investors.

If you or anyone you know are interested in joining our network, please reach out to our the Future Capital team directly at hello@myfuturecapital.com.

To stay up to date on Future Capital Capital news, subscribe to our monthly newsletter. Stay connected with our us on LinkedIn.

Download the full report here.

Related Resources

The future of investing will look different.

Our white paper on the role women will play in venture funding, the state of gender parity in business, and the most direct path to economic impact for women, outlines why we believe now is the right moment for women to lead.

How are Black & Latina Women Investors Breaking into VC?

The 2021 Black & Latina Women in VC report analyzes the professional & educational backgrounds of 108 Black and 96 Latina women in the U.S. VC ecosystem in investment roles. We identify themes and patterns to learn how they’re breaking into and thriving in venture capital roles.

The Gaingels 100 is not a ranked list, but rather a collection of amazing, accomplished and inspiring venture-backed, LGBTQIA+ entrepreneurs. They hail from all over the world, and have built, or are building, great companies of the exact kind we founded Gaingels to support and invest in.

Diversifying startups and VC Power Corridors

Startups have a seemingly intractable problem: a lack of diversity. Despite research showing that diverse founding teams have a higher rate of return than white founding teams, one characteristic of startups remains relatively unchanged: the dearth of BIPOC and women founders, investors, board members and counsel in the venture capital (VC) ecosystem.

Female Founders are Crashing the Billionaire club

As the women who created Bumble, Spanx, and 23andMe achieve new levels of wealth and success, can they open the door for the female entrepreneurs coming behind them?

Funding To Black Startup Founders Quadrupled In Past Year, But Remains Elusive

Funding to Black entrepreneurs in the U.S. hit nearly $1.8 billion through the first half of 2021 — a more than fourfold increase compared to the same time frame last year. Led by funding to early-stage startups, this year’s half-year total has already surpassed the $1 billion invested in Black founders in all of 2020 and the $1.4 billion invested the year before that.